Key farm Democrat warns Biden on tax plan

Biden to meet with Capito again Friday on infrastructure

Another warning shot from Democrats about Biden tax plans. Talks continue at the White House on infrastructure. And see if your member of Congress is leasing a car with their House budget. This is “Regular Order” for June 3, 2021.

FARM COUNTRY. One of President Biden's big tax proposals has raised red flags among farmers, and now it faces the opposition of the Chairman of the House Agriculture Committee. "Any increase in inheritance tax for those taking over farm land is untenable and will further strain a farm economy that is just now beginning to recover from the strain of the pandemic," said Rep. David Scott (D-GA).

WARNING. In a letter to the President, Scott praised the goal to act on infrastructure and education, but specifically rejected a plan to restrict 'stepped up basis' on inherited assets. Groups like the American Farm Bureau have warned such a plan will hit a much larger set of farm operations than intended.

TAXES. The stricter rules on capital gains are a major part of the Biden funding plan for his 'American Families Plan' - raising $324 billion in revenue over ten years from 'high-income households.' The opposition from Scott and other farm-state Democrats is a reminder that finding agreement just among Democrats on funding won't be easy.

BIDEN. The White House has said this is aimed at the very wealthy, as the plan would hit those with ‘gains in excess of $1 million.’ As for farms, "The reform will be designed with protections so that family-owned businesses and farms will not have to pay taxes when given to heirs who continue to run the business." Clearly, Scott and other Democrats aren't sold on that assurance.

ENFORCEMENT. One tax plan from President Biden would hire more IRS agents to help the feds ensure that people are paying what they owe to Uncle Sam. Lawmakers were told earlier this year that the 'tax gap' - the amount of tax revenues going uncollected by the U.S. - is most likely over $1 trillion per year. The Biden plan would raise $711 billion in tax revenue over 10 years.

GOP. But the idea of extra IRS enforcement is being roundly attacked by GOP lawmakers, who claim it's somehow partisan in nature. "If you enjoy IRS audits, then you’ll love the $80 billion in Joe Biden’s budget for IRS bureaucrats to use to target American families and conservatives," said Rep. Jason Smith (R-MO).

INFRASTRUCTURE. Without fanfare, President Biden met for nearly an hour at the White House on Wednesday with Sen. Shelley Moore Capito (R-WV) on infrastructure. The two will meet again in the Oval Office on Friday. “Now is the time to bring our ideas together and get this done,” Capito said.

BIDEN. The White House again publicly welcomed the talks with Capito, but at the same time emphasized that the President is definitely ready to reach a deal. “His only line in the sand is inaction,” said White House Press Secretary Jen Psaki. “He wants to sign a bill into law this summer.”

FISH OR CUT BAIT. There's growing sentiment among Democrats that it might be time to end negotiations on infrastructure, and just try to forge a package without the GOP. "If Republicans don't want to cooperate and help us seriously address the many crises we're facing today, then, yes, we have to move forward without them," said Sen. Bernie Sanders (I-VT).

JOBLESS BENEFITS. Democrats on the Joint Economic Committee released a study on Wednesday which tried to quantify the economic impact of GOP states which are cutting off extra jobless benefits to help those hit by the Coronavirus outbreak. The data from the Joint Economic Committee says the 24 states ending benefits early will hold back $7.66 billion in aid.

MULTIPLIER EFFECT. Democrats say that every $1 of unemployment insurance has an impact of $1.61 in local spending. So, they estimate the end of benefits in these 24 states will have a negative impact of over $12 billion.

THE FREE STATE. Maryland is the latest state to stop the extra $300 per week unemployment benefit. State Democrats slammed the move by GOP Gov. Larry Hogan. Rep. John Sarbanes (D-MD) called it “abrupt and ill-informed.”

IMMIGRATION. Aggravated by a lack of attention in Congress on the southern border, GOP lawmakers on Wednesday again asked a House panel to hold hearings on the surge of unaccompanied children coming in from Mexico, pressing the House Oversight Committee to ask questions about the jump in border crossings.

LETTER. "As we noted in our previous letter, this Committee held multiple hearings during the Trump Administration on the treatment of children at the border," the GOP group wrote. "It is surprising that you have failed to schedule a hearing during the current border crisis created by the Biden Administration."

AUTO LEASES. The latest spending report is out for House members, and it provides us with a fresh look at how many lawmakers are using their Congressional office budget to lease a car for official business. Just to be clear - in the House, members are allowed to spend up to $1,000 per month on a vehicle.

NUMBERS. Back in 2012, 76 House members spent some of their office money to lease a vehicle. That's now dropped in half, down to just 38 lawmakers in the first quarter of 2021. The partisan split is 27 Democrats and 11 Republicans.

FORD & GM. The two most popular leasing options are two of the biggest U.S. automakers. 12 members went through Ford dealers to get a vehicle; 11 through General Motors.

TWO CARS. One lawmaker - Rep. Terri Sewell (D-AL) - pays for two cars. One payment is $934.15 per month, and the other is $560.32 per month.

THE FULL LIST. Here’s the 38 House members leasing cars in the first quarter of 2021, and paying for it with their official Congressional office budget. (Again, this is not against the rules. Members cannot spend more than $1,000 per vehicle.)

Rep. Bobby Rush D-IL $998.73/month

Rep. James Clyburn D-SC $994.23

Rep. G.K. Butterfield D-NC $987.16

Rep. Eddie Bernice Johnson D-TX $968.33

Rep. Lizzie Fletcher D-TX $935.73

Rep. Terri Sewell D-AL $934.15

Rep. Al Lawson D-FL $903.14

Rep. Michael Simpson R-ID $871.51

Rep. Louie Gohmert R-TX $858.69

Rep. Steven Palazzo R-MS $807.29

Rep. Alcee Hastings D-FL $798.00

Rep. William Keating D-MA $772.96

Rep. Hank Johnson D-GA $754.47

Rep. Sheila Jackson Lee D-TX $754.17

Rep. Brenda Lawrence D-MI $730.75

Rep. Mario Diaz-Balart R-FL $712.75

Rep. Tony Cardenas D-CA $708.47

Rep. David Scott D-GA $704.37

Rep. Matt Rosendale R-MT $690.00

Rep. Henry Cuellar D-TX $679.34

Rep. Adam Schiff D-CA $650.00

Rep. Steve Womack R-AR $642.60

Rep. Adrian Smith R-NE $610.45

Rep. Jeff Fortenberry R-NE $585.77

Rep. Terri Sewell D-AL $560.32

Rep. Barbara Lee D-CA $523.26

Rep. Peter Welch D-VT $519.18

Rep. Robin Kelly D-IL $485.71

Rep. Mondaire Jones D-NY $483.77

Rep. Bill Johnson R-OH $478.26

Rep. Danny Davis D-IL $471.10

Rep. Andre Carson D-IN $467.35

Rep. Al Green D-TX $458.02

Rep. Mike Turner R-OH $426.94

Rep. Val Demings D-FL $401.12

Rep. Kevin Brady R-TX $389.00

Rep. Brendan Boyle D-PA $341.95

Rep. Anna Eshoo D-CA $299.73

Rep. Nanette Barragan D-CA $184.13

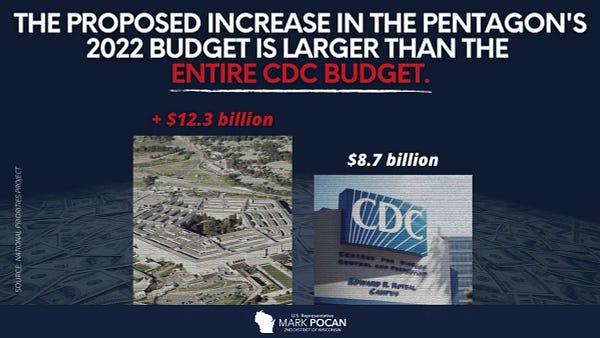

DEFENSE SPENDING. Liberal Democrats have long wanted to take a big chunk out of the Pentagon, and many of them are unhappy with President Biden's 2021 budget. "The Pentagon does not need an additional $13 billion in funding, on top of the $740 billion already allocated," said Rep. Barbara Lee (D-CA).

DOMESTIC SPENDING. A number of House Democrats have been very vocal since Friday's budget rollout, making it clear they won't help Democratic leaders pass such a big defense spending plan. "Let's address the poverty crisis in our country instead of funding bombs," said Rep. Rashida Tlaib (D-MI). "I am not voting for a war budget."

SOCIAL MEDIA. Democrats have such a thin majority that it only takes five lawmakers to break ranks - and things could go haywire for the White House on just about anything. File this away for later in the year on the budget.

MEAT PACKERS. Farm state lawmakers are pressing the feds to speed up an investigation into the meat packing industry. In a letter to top officials, the Kansas delegation to the House and Senate is asking for an update - worried by 'challenging market dynamics' for cattle producers, and 'the historically wide gap between wholesale beef prices and fed cattle prices.'

RANCHERS. Lawmakers from Montana and South Dakota have been firing off similar missives, arguing there is a lack of competition in the meatpacking industry. "It's time we get to the bottom of this for U.S. consumers & cattlemen" said Sen. Mike Rounds (R-SD).

EARMARK OF THE DAY. Rep. Ed Case (D-HI) is requesting $2.1 million to help the Blood Bank of Hawaii build a new 19,000-square foot blood testing and blood distribution center. All of Case’s local funding requests can be found at this link. Links to funding requests of all House members.

MUSE OF HISTORY. June 3, 1868. This was a rare day in the House of Representatives, as lawmakers voted to accept an election challenge, ousting a Democrat from Ohio who had been sworn into office the previous year. The details of alleged election fraud might sound familiar. Claims that foreigners had been brought in to vote. Charges of ballot box tampering. Allegations that legal voters were prevented from casting ballots. Corrupt election judges. Ballot box stuffing, and more. After an exhaustive investigation, with hundreds of interviews, the House voted 80-38 to declare Ohio Republican Columbus Delano the winner, ousting Democrat George Morgan. Morgan would turn the tables and win back the seat in November, while Delano would go on to serve in the administration of President U.S. Grant.

LEGISLATIVE PROGRAM:

The House next has votes the week of June 14.

The Senate next has votes on June 7.

President Biden’s daily schedule link.

Follow me on Twitter @jamiedupree. Email me at jamiedupree@substack.com

See the archive at http://jamiedupree.substack.com